2026-03-03

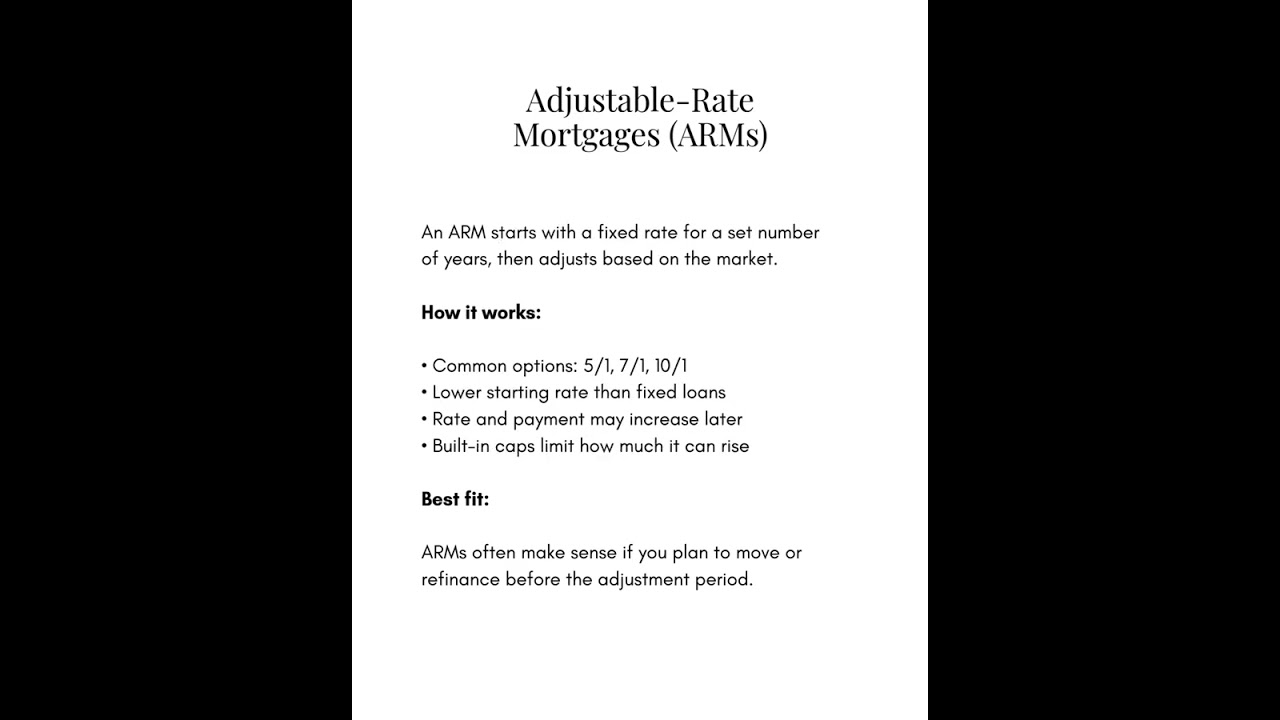

🚨 FIRST TIME HOMEBUYERS – THIS IS FOR YOU! 🚨 Thinking about buying your first home in 2026… but not sure where to start? I’m hosting a FREE Zoom First-Time Homebuyer Seminar on: 📅 March 17th ⏰ 7:00 PM (CST) 💻 Live on Zoom In this class, I’m breaking down:…